State Bank of Pakistan has directed all commercial banks, including microfinance and Development Finance Institutions (DFIs), to verify banks accounts of customers including individuals, corporations and associations with biometric data and proper submission of documents starting from November 30, 2018.

The drive will commence in phases with respect to different categories of customers’ account and will continue till 30th June 2019 throughout the country in all branches and sub-branches of banking companies.

The decision for the re-verification of bank accounts was taken after fake accounts with suspicious transactions were unearthed by intelligence agencies in the recent weeks.

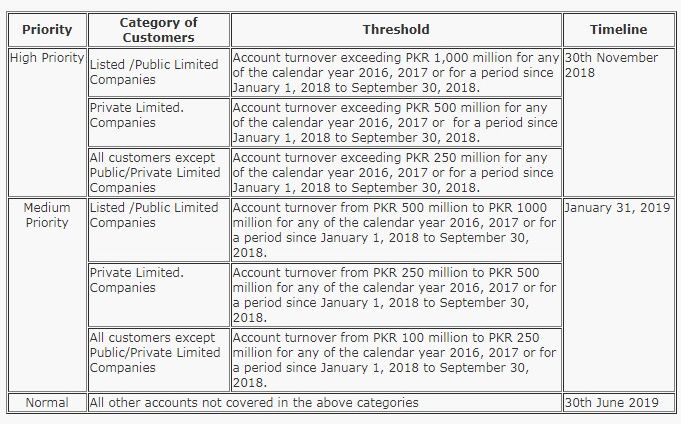

The central bank has come up with a schedule for different categories of banks accounts made or maintained by public listed companies, private and multinational corporations, and individuals.

Below is the calendar for listed and public sector entities, private and multinational corporations and individuals customers.

Guidelines for Banks

The central bank directed that all banks/DFIs must ensure strict observance of all applicable instructions including identification and verification of customers and their beneficial owner(s) and obtain information on the purpose and intended nature of a business relationship.

The monitoring mechanism in place at banks/DFIs should be adequately resourced and strengthened to ensure that the transactions being conducted in the accounts are consistent with the banks/DFIs’ knowledge of their customer, business, risk profile and the source of funds.

With the objective to know the ultimate beneficial ownership of accounts/transactions, the banks/DFIs shall enhance their efforts to obtain relevant information and examine background and purpose of all complex and unusually large transactions and unusual patterns of transactions, which do not commensurate with customer profile or have no apparent economic or visible lawful purpose.

Banks/DFIs are also advised to enhance their efforts to obtain and maintain up-to-date information relating to their ultimate beneficial owners, i.e. natural persons or individuals who ultimately own or control the company. The banks/ DFIs may seek such ultimate beneficial ownership information from their relevant customers during the Customer Due Diligence (CDD) process.

Modus Operandi

To further strengthen the measures already in place and mitigate the money laundering and terrorist financing risks, banks/DFIs are advised to immediately take the following steps:

- Ensure optimal utilization of biometric technology and carry out biometric verification of the existing customers (if already not done) as per thresholds given in the above table.

- Biometric verification of persons authorized to open and operate the account of legal entities or legal arrangements shall be conducted.

- In case of customers whose eligible identity documents are other than biometrically verifiable documents, re-validation/ verification of identity shall be done based on documents, data or information obtained from the customer and/or from reliable and independent sources having regard to bank/DFI’s own assessment of materiality and risk.

- Confirm compliance status of their internal risk review of remaining legacy portfolio of customers, as required vide BPRD Circular Letter No. 20 dated June 14, 2017 latest by October 31, 2018.

- Attention of all banks/DFIs is invited towards Regulation-1 (Customer Due Diligence – CDD) of AML/CFT Regulations, which requires banks/DFIs, on on-going basis, to perform such CDD measures as may be appropriate to its existing customers having regard to their own assessment of materiality and risk but without compromise on identity and verification requirements. Thus, ongoing CDD is an essential part of an effective AML/CFT regime.

SBP, during the course of the inspection, will particularly assess the compliance of the above requirements and non-compliance will result in appropriate enforcement action in accordance with relevant laws.