KARACHI: Compared to the previous quarter, there was a notable increase in digital banking transactions during the second quarter (October-December) of the current fiscal year, as reported by the central bank. The number of transactions made through mobile apps increased by 29% to 280 million, while those made through internet banking increased by 15% to 57 million.

The latest quarterly “Payment Systems Review” from the State Bank was released on Wednesday, and it showed that the value of mobile banking transactions over the past three months has crossed the Rs11 trillion threshold for the first time, totaling Rs11.2tr. Online banking transactions reached a value of Rs5.4 trillion.

During the quarter, there were 8.3 million more mobile and 10.8 million more internet banking users than there were the previous one.

According to the research, the percentage of transactions made through mobile apps and the internet exceeded that of card-based transactions.

Over 107 million Raast transactions have been made, totaling Rs2.3 trillion.

The research states that there was a comparable growth pattern in e-wallet transactions, with a quarterly increase of 31% in volume and 37% in value.

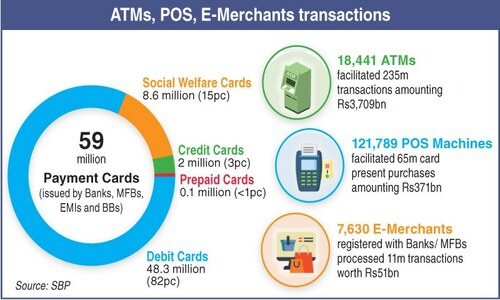

The number of card-based transactions at ATMs, point-of-sale (POS), and e-commerce platforms increased significantly during the quarter, coming to 235 million (up 10%), 65 million (up 10%), and 11 million (up 13%), respectively.

With 229 million transactions through ATMs during the quarter, clients continued to choose them over over-the-counter (OTC) channels for cash withdrawals.

Additionally, 82 percent of retail transactions were completed digitally in the October–December quarter, up from 80 percent in the July–September period, indicating a steady rise in the use of digital payments.

On the other hand, the report stated that just 15% of retail payments were made through digital channels and that 85% of retail purchases were made over-the-counter.

During the current review, it was observed that four significant tendencies stood out.

First, there was a steady uptake of internet and mobile banking, as seen by the rising volume of customers and transactions over these platforms.

According to the research, “Together, these two channels constitute the largest share of 50pc in total digital transactions.” It stated that because these channels were increasingly using Raast, this tendency was predicted to continue.

The rise in Raast usage was the second trend. According to the study, Raast conducted 107 million transactions in the current quarter, totaling over Rs2 trillion. Since its launch in January 2021, Raast has handled 343 million transactions, totaling over Rs7 trillion in value. It stated that Raast is “becoming a game-changer for digitising the payments ecosystem in the country” with its rapid and ongoing build-up in growth momentum.