Merely 16% Pakistanis claim to own and/or use a bank account, including a traditional bank account as well as a mobile account, according to a survey conducted by Gallup Pakistan for the State Bank of Pakistan.

This survey is part of a special series that aims to foster an empirical understanding of financial inclusion in Pakistan and to create a collaborative network of individuals working on the topic. The survey addresses the current proportion of Pakistanis that are included in the formal banking sector of the country. Although 16% is still a rather small portion of the population, this figure is on the rise.

In 2008, the segment of the Pakistani population that was using bank accounts stood at 8%. Thus, in the following seven years, that proportion has risen by 6%.

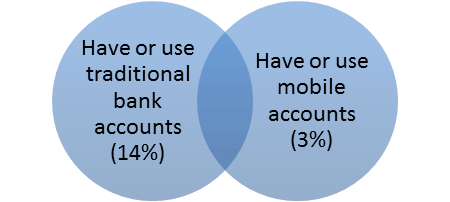

14% Pakistanis use a traditional bank account while 3% use a mobile account.

A nationally representative sample of men and women from across the four provinces was asked, “I will now ask you about your experience with financial services. I am going to tell you financial services and products. For each of them, please tell me if you use it or have it now.”

In response to this question, 14% Pakistanis said that they have or use a traditional bank account.

A traditional bank account includes a post office saving account, someone’s post office savings account, basic banking account, current or cheque account, PLS/Saving account, Someone’s bank account, term deposit account, Islamic current or savings account and account used to get assistance money from the government. Furthermore, 3% Pakistanis said that they have and/or use a mobile account.

Thus, this proportion included people who had their own mobile account and those who were using someone else’s mobile account. 1% of the Pakistani population was using both a traditional bank account and a mobile account.

Source: Access to Finance Survey 2015: State Bank of Pakistan/Gallup Pakistan

Gallup Pakistan, in collaboration with HORUS Development Finance, conducted an extensive survey in over 10,000 households across Pakistan. The primary aim of the study was to determine the extent of financial services being used by Pakistanis as well as to provide insights into the barriers faced by the Pakistani public in accessing formal financial services.

The data was released as part of Access to Finance Study 2015. Fieldwork carried out by Gallup Pakistan, the Pakistani affiliate of Gallup International, among a sample of 10,000 households across rural and urban areas of all four provinces of Pakistan, during March 27 – June 12, 2015. Error margin is estimated to be approximately ± 2-3 per cent at 95% confidence level.