The Second dot-com Bubble

Sadly, the economy has returned to the dot-com bubble levels of 1999. Companies like Snapchat are getting a $3 billion plus valuation with no current revenue. In the US, the total IPO volume was $34.9 billion for the first nine months, with 149 deals, up by 6% from the same period in 2012. Activity was the highest since 2007, when the U.S. had a total of 170 IPOs, before the economic recession killed many deals.

Venture capital data from Silicon Valley is showing that technology is taking up most of the VC investments at the moment, and that health-care investment has fallen. Data from research firm CB Insights’ Silicon Valley Venture Capital Almanac showed that venture funding in the third quarter of 2013 was the strongest in five years. In the third quarter, VCs invested $2.8 billion in 267 tech startups.

The Internet sector gobbled up more than 40% of venture capital funding in both 2012 and the first nine months of 2013. Funding of mobile companies grew to 15% in 2013 so far, up from 7% in 2010. Healthcare and cleantech fell to 24% of Silicon Valley VC funding, down from 29% in 2012.

“Tech is increasingly taking most of the VC dollars,” said Anand Sanwal, CEO and co-founder of CB Insights. “But in terms of dollars, there is no way that it is going to approach that (the record levels of 2000). VC as an asset class has been shrinking.”

Like most other publicly traded Web 2.0 or social media companies, Twitter is extremely overvalued: it now has a lofty $25 billion market capitalization, despite accumulating $300 million in losses over the past three years, including a $65 million loss in the most recent quarter. Taking a cue from the dot-com bubble’s playbook, investors have resorted to valuing today’s profitless tech companies on a price-to-sales ratio basis, yet even this metric shows that Twitter’s valuation is quite overvalued at 22 times its expected 2014 sales, which is approximately double the multiple carried by Facebook and LinkedIn (which have high multiples in their own right).

Take twitter for example, though just over seven years old, Twitter’s unrealistically high market capitalization makes it worth more than long-established companies such as Alcoa, Harley-Davidson, and News Corp, which is the world’s largest media conglomerate company. Twitter’s market capitalization isn’t much lower than Yahoo!’s $33.74 billion market capitalization, even though Yahoo! is expected to generate $4.43 billion in revenue and $1.5 billion in adjusted earnings in 2013, versus Twitter’s expected 2014 revenues of $950 million and no earnings to speak of until at least 2015. Though investors are betting that Twitter will grow into its valuation, I strongly believe that they have gotten ahead of themselves and should be assigning a far more conservative valuation to a speculative investment like this. Even if Twitter becomes a profitable company, most of their future growth is likely already priced into the stock, which means that even the slightest disappointment will send it tumbling.

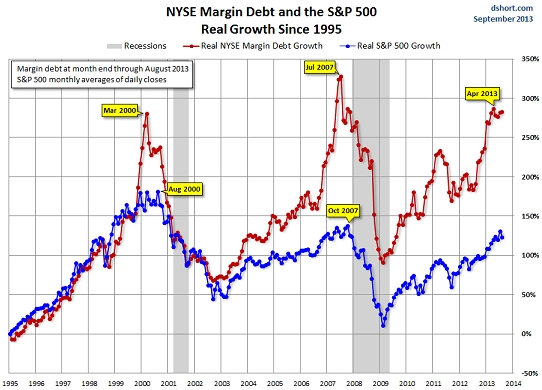

Still, believe the facts then look at the following graphs showing similarities in the trend of today with trends of recent bubbles:

The U.S. interest rates have been extremely low since 2008, which is forcing investors out of conservative investments, and into riskier investments such as stocks, which is inflating investment valuations.

As I discussed in great detail in my report, the U.S. stock market valuations are currently in bubble territory. A valuation metric called the Shiller P/E Ratio (price to earnings ratio based on average inflation-adjusted earnings from the previous 10 years) shows that U.S. stocks are as overvalued as they were before the most important generational bear markets of the past century, though some of those bear markets occurred in real terms rather than in nominal terms (the bottom chart is the S&P500):

The total U.S. stock market capitalization to GDP ratio, which Warren Buffet described as “probably the best single measure of where valuations stand at any given moment”, clearly shows that stocks are quite overvalued:

Index or VIX is a gauge of investor fear, and indicates buying opportunities in times of fear (readings of 40 and above), and times to be cautious when investors are too complacent (readings under 15). The VIX is indicating that investors are too complacent, which is exactly what happened during the last bubble cycle from 2004 to 2007.

Another sentiment indicator, NYSE margin debt, has soared to levels that marked the peaks of the prior bubbles in 2000 and 2007. This shows that traders are so confident in the market’s prospects (a contrarian signal) that they are leveraging their bets with borrowed money, which is further boosting the market by increasing traders’ buying power.

Conclusion:

After all this knowledge, you would have come to the conclusion that we are at the end of something big, even if it’s not the Armageddon. Today, there are small bubbles all over the world, i.e., countries like China are also having bubbles, as like Dubai, they are having massive residential constructions from which a lot is not required. When the Chinese realize this, there is going to be a big crisis there as well. On the whole, the stimulus packages and bailouts are helping the corporations overspend, which is creating an artificial demand in different markets all over the world.

When people start questioning the authenticity of these artificial demands, there is going to be a complete meltdown of the global economy. We need to review our financial system completely, or rather, a rethinking of capitalism is needed; financial products of mass destruction cannot be allowed. Sometime soon, the alcoholic economy would not go on with giving it more alcohol; let that time not come when the alcoholic dies, when even Gold would not be able to save us!

This author has confused the financial disaster called Pakistan with the prosperous success story called USA…he is incredibly negative and has no understanding of the power of a strong capitalist system to overcome and prosper from “economic bubbles”…yes we all know that the world economy went through a rough patch exacerbated by the uncontrolled terrorism of 9/11 produced by Islamic extremists…but the USA eliminated the source of that problem in Afganistan…and the fact is we all survived and the economy is now picking up and resuming its progress…the authors prediction that the USA will fail is grossly incorrect and his understanding of international economics is totally inadequate…if he really knew anything about monetary policy he would know that ” capitalism is the cure for poverty”….his hate for the USA and jealousy for western success is not based on facts but on misguided delusions..

Let him dream on mate. The best part about sites like PKKH is that they end up passing on propaganda and confuse the poor Paki even more.

More deluded Pakis are a good sign – because sooner or later, someone will wake up (red pill blue pill scenario) and fix the Matrix that is Pakistan

eddi who edited your small-brain

how can u be one of those blindfold people, who can’t see the disaster being brought upon humanity by the IMF, the banks and the one-sided justice of international orgs. like the UN & THE ICJ, perhaps ignorants like you vote for the status quo in the US in every election to bring doom closer to humanity every elections,, nobody is hate/jealous with the US, but everybody can’t stop calling a cancer a cancer just to keep the blind happy..

I agree that capitalism is the cure for poverty but capitalism has a tendency of creating cyclical bubbles that get burst and put the economies in depression.

Today US economy is no.1 and most countries in the world have USA as their no.1 business partner and foreign investor. Failure of USA will spell doom for the world but its highly highly unlikely.

The slow down could largely be attributed to

1. US and NATO countries intervention in Iraq followed by global war on terror as trillions of dollars have gone into these wars, and

2. collapse of soviet union made more and more nations adopting capitlist economy that led to large scale globalization that helped creating a bubble.

Getting over a bubble burst is a slow process and an eye opener.